Trading forex in Indonesia requires careful consideration when selecting a brokerage. A broker acts as your direct connection to global currency markets, and their reliability, regulatory standing, pricing structure, and trading conditions all influence the outcome of your trades. Choosing a broker is not a matter of selecting the most visible platform; it requires verification and evaluation based on objective factors.

This article offers a practical guide to choosing a dependable broker Indonesia that aligns with your trading goals. It covers legal requirements, platform quality, execution standards, fee structures, and more—all framed in clear and factual terms.

Regulatory Status and Safety Measures

The first thing to confirm is whether the broker operates legally in Indonesia. The financial regulatory body overseeing financial services in Indonesia is Otoritas Jasa Keuangan (OJK). However, most forex brokers in the country operate under licenses from international regulators such as ASIC (Australia), FCA (UK), or CySEC (Cyprus). It’s important to verify that the broker holds a valid license from one of these authorities.

Regulation is important because it requires the broker to comply with a set of standards, including:

- Keeping client funds in segregated accounts

- Submitting to regular financial audits

- Offering dispute resolution options

- Maintaining a minimum capital base

To check a license, visit the official website of the relevant regulator. If the broker cannot provide documentation or their license is unverifiable, you should avoid using their platform.

Fee Structure and Trading Costs

Trading costs reduce net profit or increase losses. Brokers typically earn through spreads, commissions, and sometimes fees for inactivity or account maintenance.

Here’s a basic breakdown of costs to check:

| Cost Type | Description |

| Spread | The difference between bid and ask price |

| Commission | Fee charged per trade or per lot |

| Swap | Fee for holding a position overnight |

| Inactivity Fee | Charged for accounts left idle |

Spreads may be fixed or variable. While tight spreads seem attractive, always read the full fee disclosure. Some brokers apply low spreads but include higher commission rates or execution delays.

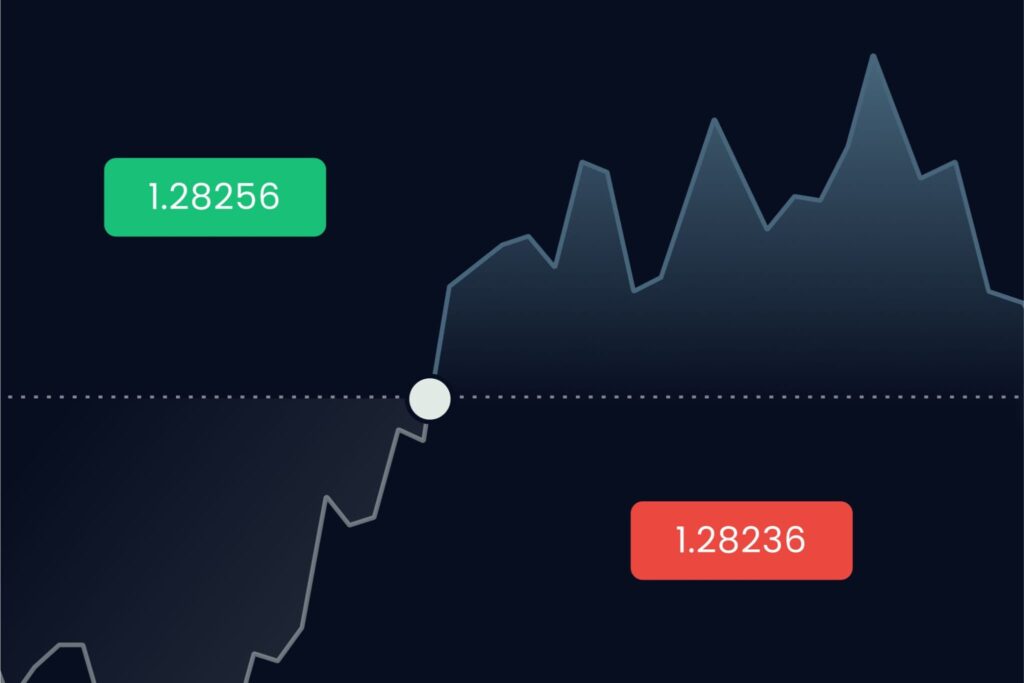

Trading Execution and Performance

Execution speed plays a large role in the quality of your trading experience. Delays or slippage can result in worse prices than expected, especially in high-volatility conditions.

Consider these execution metrics:

- Order execution speed (measured in milliseconds)

- Slippage reports (difference between requested and executed prices)

- Order types supported (market, stop, limit, etc.)

- Requote frequency

Fast and reliable order execution is particularly important for day traders and scalpers. Most brokers publish average execution speeds or allow third-party testing through platforms like tradingview.com or forexfactory.com.

Trading Platform Features

The trading platform is your workspace. It should be stable, responsive, and provide essential tools such as real-time data, charting options, and custom indicators. Some brokers offer proprietary platforms, while others support third-party solutions.

Before choosing a broker, confirm:

- Availability of web, desktop, and mobile platforms

- Access to real-time price data

- Customizable charting tools and technical indicators

- Integrated news feeds or data from sites like fxstreet.com

Traders looking for mt5 download functionality should also verify if the platform supports this version and whether Expert Advisors (EAs) or algorithmic trading are permitted.

Asset Range and Trading Options

While most traders focus on major forex pairs, others may want access to additional instruments such as commodities, indices, or crypto-assets. If you plan to expand your trading to instruments beyond currencies, check the broker’s offering.

Questions to ask:

- Are all major and minor forex pairs available?

- Can I trade commodities or indices in the same account?

- What are the minimum trade sizes?

- Does the broker offer margin trading and how is it structured?

Also, find out whether the broker uses market execution or operates as a dealing desk, as this can affect pricing and slippage.

Minimum Deposit and Account Types

Some brokers allow users to open a trading account with a very low deposit, while others set higher thresholds. This is especially relevant if you are just starting and wish to limit your initial investment.

Review these aspects:

- Minimum deposit required

- Account currency options

- Availability of swap-free accounts

- Support for micro or ECN accounts

Account type may also influence available features. ECN accounts often offer better spreads but involve commission charges, while standard accounts may use higher spreads with no commission.

Customer Support Quality

If something goes wrong—such as a failed withdrawal or platform issue—responsive support is necessary. A broker should offer:

- 24/5 or 24/7 customer support

- Multiple contact channels (chat, email, phone)

- Clear instructions for account issues or complaints

You can test support quality by contacting them with basic questions before opening an account. This gives a practical measure of responsiveness and clarity.

Deposit and Withdrawal Options

Brokers in Indonesia typically offer local bank transfers, e-wallets, and card payments. The speed and transparency of fund processing matters just as much as trading conditions.

Evaluate the following:

- Available payment methods

- Withdrawal processing time

- Currency conversion policies

- Internal processing fees (if any)

A good broker will publish its fund-handling policies in detail. Look for delays, verification conditions, or hidden transaction costs.

Data Privacy and Account Security

Online trading involves submitting personal identification and financial data. Make sure the broker uses proper security measures:

- SSL encryption for data transmission

- Account protection features like two-factor authentication

- Clear privacy and data policies

Traders should also avoid brokers that require unnecessary access to personal information or delay withdrawal requests under vague conditions.

Educational Content and Market Analysis

Even if you’re not seeking formal training, the availability of market analysis and news updates adds value. Some brokers provide daily reports, economic calendars, and analysis feeds.

Check if the broker integrates content from credible sources like tradingeconomics.com or thebalancemoney.com, which help you stay informed about broader market movements.

Choosing a reliable broker in Indonesia involves more than comparing spreads. Traders should verify licensing, study fee structures, check platform stability, and understand the service quality across support, withdrawals, and tools.

Use available resources to gather information from regulatory bodies and trading communities. Stick to facts, examine data critically, and make decisions that align with your goals, risk tolerance, and trading strategy.

A broker is a service provider—not a partner. Choosing the right one means demanding clarity, performance, and accountability. Making the right choice from the beginning saves time, reduces stress, and contributes to a more consistent trading experience.