Most budgets feel like a cage. They’re built on a list of “can’ts” and tell you where your money already went. Zero-based budgeting flips the script. Before your next paycheck even lands, you give every single dollar a specific job to do. Think of it as a detailed blueprint for your financial month.

You plan your month so every dollar gets a job. Your income lands, and you send it all out to specific tasks. Rent has its share. So does your savings account. Even your morning coffee gets its own line in the plan. That final zero in the calculation means your money has its marching orders. You stop cleaning up financial messes and start directing the show from the beginning.

Your Digital Foremen: Apps That Handle the Heavy Lifting

You could use a notepad for this. Most people find that gets messy fast. A good app does the adding and subtracting for you. It watches your cash flow all month long.

Everything lives in one spot, so you aren’t digging through scraps of paper. The best ones change how you see your money, not just where you write it down.

YNAB: The Veteran Project Manager

YNAB (You Need A Budget) is built on a strict, four-rule philosophy that teaches you to “give every dollar a job.” It’s less of a passive tracker and more of an active money management system.

The app forces you to confront your current financial reality and make decisions based on the money you actually have right now, not what you expect to have. You get tools for setting targets, creating detailed reports, and a solid phone app.

Figuring everything out takes a bit more time at the start. But there’s a whole crowd of users ready to help. They offer free workshops and a podcast that walks you through the process. Using it feels less like installing software and more like joining a class on your own finances.

EveryDollar: The Straightforward Site Supervisor

Created by Dave Ramsey’s team, EveryDollar is all about simplicity. It makes starting a zero-based budget feel immediate and uncomplicated. You name your income, you create your spending categories, and you drag and drop to assign every dollar.

The free version requires manual transaction entry, which some find builds greater awareness of their spending. The premium version connects to your bank accounts to automate the tracking. It’s a no-frills app that sticks to the core principles of the zero-based method without overwhelming you with extra features.

Goodbudget: The Digital Envelope System

This app is a modern, digital take on the classic cash envelope method. Instead of physical envelopes for “Groceries” or “Entertainment,” Goodbudget gives you digital ones. You fund your envelopes at the start of the month and spend directly from them.

You watch a digital envelope get thinner as you spend. That shrinking bar graph makes your choices feel immediate. This works well for people sharing expenses.

You and your partner can see the same envelopes on your phones. It stops the “did you pay the electric bill?” text messages and keeps your spending plans connected.

Finelo: The Financial Literacy Coach

While Finelo’s core strength is investment education, its approach is a masterclass in the mindset needed for zero-based budgeting.

Its powerful investing simulator gives you a virtual portfolio to practice with, teaching you to assign every virtual dollar a job in the market. This builds the same “planning muscle” you need for a personal budget.

Finelo.com offers short daily lessons. They explain the budgeting reasons. You learn why saving matters. You see how to handle debt. The lessons show you how to set financial targets. This knowledge makes a budget feel important. It gives your plan a purpose.

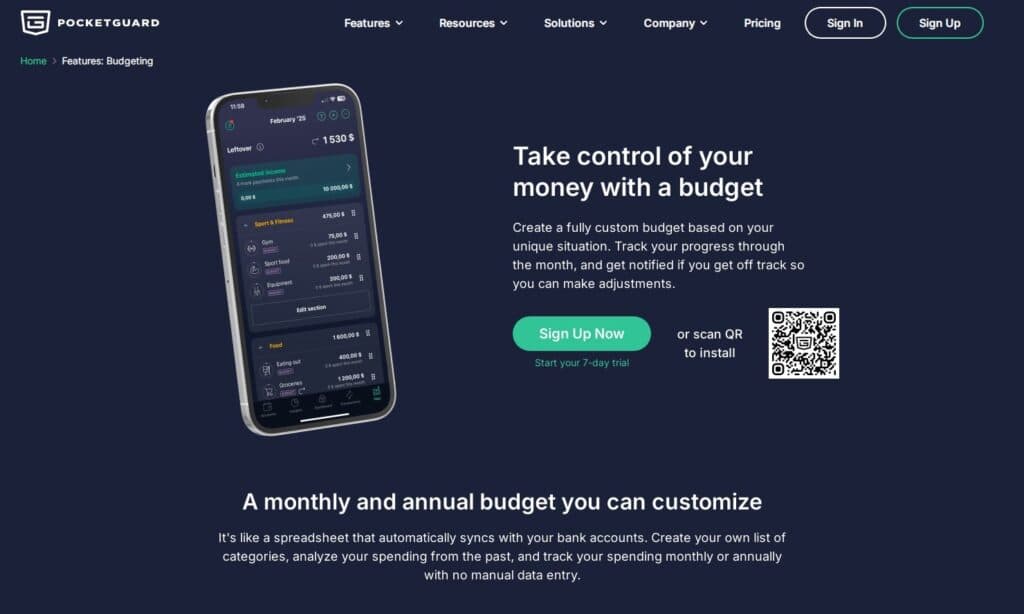

PocketGuard: The Simplified Inspector

PocketGuard pares everything down to one figure. Its “In My Pocket” number tells you what’s left for casual spending once your bills and plans are covered. The app sorts your transactions for you most of the time.

Its system also scans your regular payments, looking for chances to trim your bills without you having to hunt for them. While it may not enforce the zero-based method as rigidly as YNAB, it’s perfect for someone who wants a clear, simple answer to the question, “Can I afford this right now?”

Laying the Foundation: Your First Blueprint

Knowing which app to pick is the first step. Using it to build your first blueprint is the next. The process is more important than the tool.

Start by finding your numbers. How much money do you have right now? This is your starting balance. Then, list every single expense you can think of, from your mortgage to your monthly streaming subscription. Don’t forget non-monthly costs like annual insurance payments or holiday gifts—divide these by twelve to build them into your monthly plan.

Now, assign your dollars. In your chosen app, fund your categories until your available money hits zero. Your first attempt won’t be perfect. You’ll forget a category or underestimate a cost. That’s normal. The magic of this system is in the adjustment.

When you overspend in one category, you don’t just give up. You move money from a less important category to cover it. This act of consciously re-prioritizing is where you truly take control.

The “Why” Behind the Zero: Making Your Budget Stick

Relying only on willpower to manage money sets you up for a fall. Your plan seems fine until a rough Tuesday hits or a friend suggests a last-minute trip. The trick to keeping a budget alive isn’t better tracking. You have to link your everyday spending categories to the bigger things you want your money to do for you later on.

Think beyond the categories. “Dining Out” isn’t just a $150 limit. It’s the trade-off between a few extra takeout meals and hitting your “New Laptop” savings goal two months earlier. “Entertainment” isn’t a restrictive number. It’s the conscious choice to fund a subscription service you genuinely use, rather than letting five others drain your account unnoticed.

This is where an app’s features become powerful. Use the goal-tracking in YNAB or the envelope system in Goodbudget not just as organizers, but as visual reminders of your progress. Watching your “Emergency Fund” envelope grow from a sliver to fully funded provides a psychological reward far more motivating than just seeing a number in a bank account.

Your budget becomes a dynamic map of your priorities, not a list of restrictions. When you see your financial life laid out this way, a “no” to an impulse buy doesn’t feel like a loss. It feels like a strategic “yes” to something you’ve already decided you want more. The zero at the end of the month stops being a mathematical result and starts being a statement of complete control.

Final Thought: Your Blueprint, Your Build

A zero-based budget isn’t a financial straitjacket. It’s the blueprint that gives you the freedom to spend without guilt, because you’ve already confirmed the money is there for that purpose. It turns anxiety into action.

The app is just the instrument. The change happens inside your head. You stop asking where your cash disappeared and start directing its every move. Find the one that feels easiest to open on a busy day. Put your first simple plan together. That feeling of finally seeing your whole financial picture is sitting right there, ready for you.